The Asian beauty market, valued at over $149 billion, is heavily influenced by digital channels. From January to September 2017-2018, Japan saw a slight increase in engagement among influencers with 1 million+ followers, while South Korea experienced higher engagement with those under 20,000 followers. Brands should target micro-influencers in South Korea and top influencers in Japan for 2019.

Published On: September 20, 2018

The Asian beauty market is defined by its ability to swiftly launch new brands, new products and new technologies charged by the adoption of the digital world which is completely reshaping the retail market. With over 9.9% of beauty product sales occurring online in Asia, digital channels have lowered barriers to entry, enabling consumers from all generations to purchase their desired beauty products anywhere. With an increase of over 6.4% in beauty and personal care products in Asia in 2017, the beauty market has reached over $149bn in sales and today represents one of the most valuable segments of consumer goods worldwide.

Consumer interest in Asia goes beyond product information and pricing. With one of the highest levels of internet penetration on Earth, savvy shoppers are looking online for product usage videos, online referrals, and bespoke information through key influencers online. Therefore vlogs, editorial blogs, tutorials, consumer reviews, and social media channels have become an important arena for consumer decision-making – and companies must ensure their online presence remains satisfactory since consumers see the internet as a crucial channel for communication and knowledge.

Two of Asia’s key players in the beauty space are South Korea and Japan, both home to dozens of up and coming beauty brands as well as established conglomerates. In this week’s blog, we will look into the engagement rates of beauty influencers in South Korea and Japan across January-September 2017-2018 to see if there have been any changes.

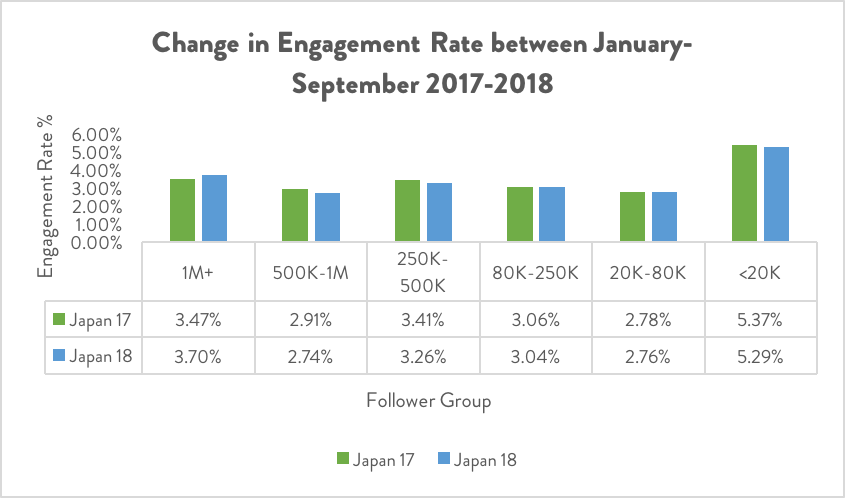

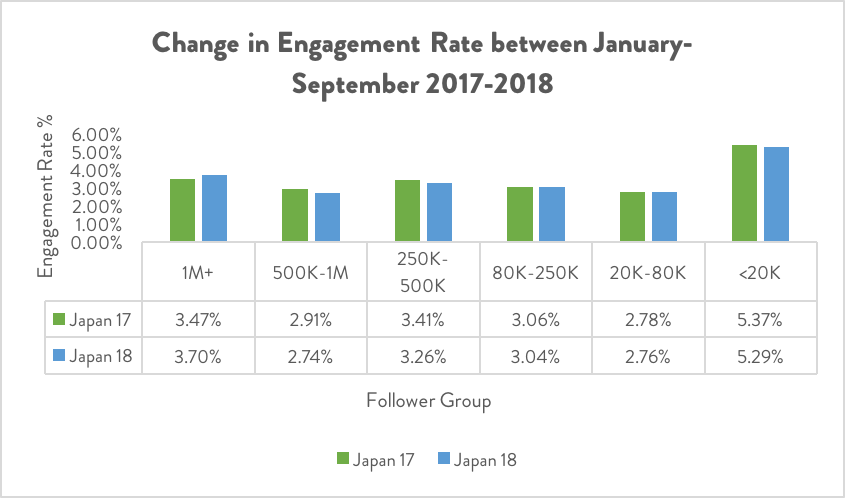

Japan January-September 2017-2018

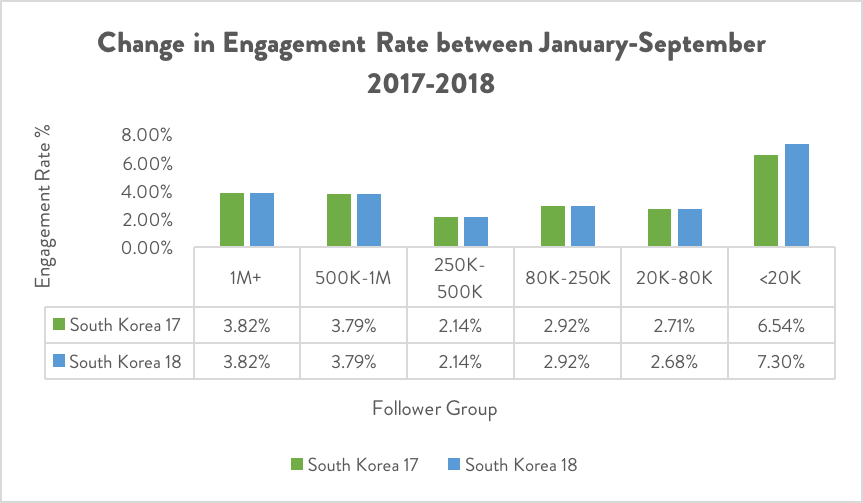

South Korea January-September 2017-2018

Starting off with Japan, we can see that engagement rates for the majority of groups are roughly the same without little change. The one group that has seen changes in engagement rate is the 1 million+ follower segment which has seen an engagement rate change from 3.47% in 2017 to an increase of 3.70% in 2018.

Moving onto South Korea, similarly, there are very few changes in engagement rate among the different segments within 2017-2018 (January-September). However interestingly, on the polar opposite end to Japan, the one segment South Korea has seen a change in is the <20K follower segment which has seen an increase in engagement from 6.55% in 2017 to 7.30% in 2018.

Brands and agencies can use the data above when deciding their 2019 pan-Asian influencer strategy. It may be worth looking into investing in micro influencers in South Korea compared to big celebrity influencers in Japan within the coming year.

Keep informed with the latest trends, reports, and case studies from the world of influencer marketing.

In beauty, things move fast. But strategy? That’s what sets the leaders apart.

Our 2025 Beauty State of Influence Report is packed with insights, but knowing how to turn those into action is where the real value lies. Whether you’re optimising influencer partnerships, reallocating budgets, or jumping on the right trends, here’s how to make the most of your data.

WeArisma’s Personal Care 2025 State of Influence Interactive Report – The Definitive Guide to Winning in Bath and Body, Hair Care, Skincare, and Wellness Through Influencer Strategy

The personal care market is booming – but only the most emotionally resonant brands are cutting through the noise. Authenticity, expert credibility, and self-care storytelling are driving the next wave of influence.

Our Personal Care 2025 State of Influence Report reveals how Dove, Nivea, Aquaphor, and Bevel are shaping the future of the category – and how your brand can do the same.

Stay up to date with the latest industry trends and topics

Discover how WeArisma can help you harness the power in influence, grow your brand’s presence, and achieve measurable success.

WeArisma combines the power of AI, influencer marketing and social listening to deliver smarter, scalable strategies with real impact.