“The luxury menswear market has witnessed steady growth over several years alongside the expanding online community of #menswear enthusiasts.

Fashion conglomerates are grasping at the opportunity to leverage off the growing interest in the menswear market which is set to out-pace womenswear across the world by 2020, according to research by Euromonitor International. Several industry giants such as Balenciaga, Burberry, and Gucci, have signalled Millenials and Generation Z as a key driving force behind the changing shape of the menswear market.

As these generations – who total 3.5 billion, increasingly resort to social media communities to inform their purchasing decisions, it’s important that brands collaborate closely with influential sources (such as influencers, press and celebrities) to reach that very audience. To do so, in an evolving and competitive space, global brands are increasingly working with technology and insights companies like Wearisma to inform their decision making and stay ahead of the curve.”

Jenny Tsai

CEO and Founder, Wearisma

Wearisma’s analysis reveals that the appetite for menswear content is strong…

After years of showing joint women and men’s collections, Gucci’s A/W 2020 runway show in Milan was the first time in 4 years the luxury giant showcased a show consisting largely of menswear. To determine the strength of Gucci’s comeback, Wearisma’s Research and Insights team analysed influencer, celebrity and press conversations during the A/W 2020 Men’s Fashion Week shows.

As dictated by the findings, the reception to Gucci’s latest menswear offering is a clear example as to why luxury brands should place a greater emphasis on this product category and utilise menswear content to court online audiences.

Beyond the revelation that Gucci ranked no. 1 among the Men’s A/W 2020 shows by mentions, Wearisma’s analysis also discovered that the brand’s A/W 2020 show generated close to the same level of mentions as its SS 2020 womenswear show. These insights support findings that the appetite for Menswear content is evolving.

…and this appetite extends beyond fashion week

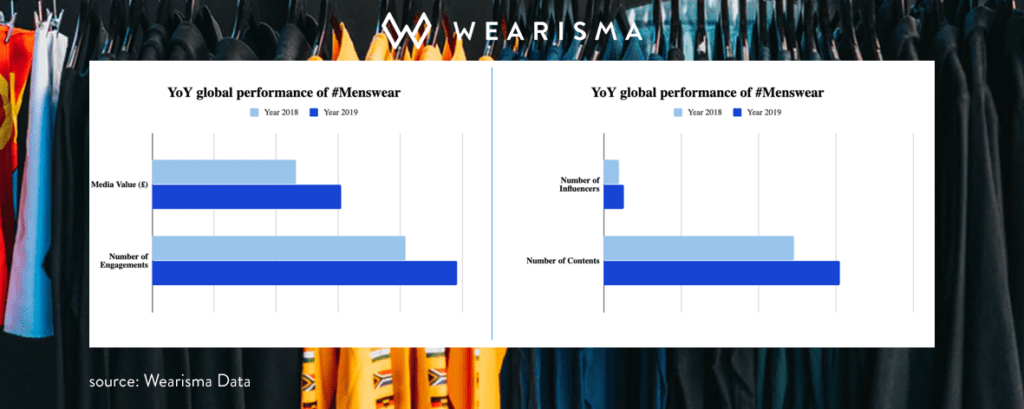

Data from Men’s fashion week only reveals a portion of the story. When analysing the way Menswear conversations have evolved globally, Wearisma’s analysis highlighted that since 2018, the amount of people discussing Menswear online has grown by 23% year-on-year while Menswear content has increased by 19%. In line with the growth of the value of the global menswear market which grew by 6% between 2018 and 2019, Wearisma’s analysis also indicated that the Media Value of menswear content also grew globally by 24%.

Research from Business Wire has revealed that China, the US, Japan, Germany, and the UK are the top 5 countries contributing to the growth of the global menswear market, with China leading the pack. Similarly, when investigating the growth in Media Value for menswear content among these countries, Wearisma’s analysis also reveals that China comes out on top with a staggering 73% growth between 2018 and 2019. These figures underline the need for brands to leverage data to understand the geographies that will be the most receptive to menswear content.

Gen Z and Millenials are changing the way we consume menswear

Brands are not only looking towards the younger generations for menswear inspiration on a product level. The way Millenials and Genz’ers consumer menswear content online has changed the way brands speak and sell to their customers. This shift has stemmed from findings which highlight that Millenials are expected to make up 50% of spending in the personal luxury market.

According to a study by Visenze, ‘60 per cent of Millennial and Gen Z consumers revealed that they were likely to complete retail purchases via their mobile and nearly 80 per cent discovered products they liked via mobile’. This shift in consumer behaviour explains why brands like Burberry have developed instant message apps and other generational marketing tactics like ‘product drops’ to appeal to this growing, digitally-native audience. When analysing Burberry’s top 20 influencers by Media Value, Wearisma’s findings revealed that 45% were Millenials, 35% Gen Z with the remaining 20% belonging to Gen X, adding credence to the brands desire to shift their gaze towards a younger audience.

If brands continue to develop new ways to engage with this growing audience its important that they harness the power of data. Taking a data-driven approach to brand-consumer interactions will enable the former to understand how conversations in areas like Menswear are shifting, creating more dynamic and ultimately more fruitful communications.

Wearisma insight: Wearisma’s insights paint a promising picture for the future brands should look to expand their investment in menswear. However, this investment cannot be entered into blindly. By empowering themselves with intelligent, data-driven insights, brands will gain an understanding of the specific markets that will benefit best from this investment and more specifically, how individuals in these markets want to be spoken to.