Fresh off the heels of an exciting new partnership with CEW France – a leading network for beauty professionals, Wearisma has launched ‘The State of French Beauty Influence’ white paper. This joint publication delivered fresh insights into the growth of the beauty industry and how Influencers are driving online conversations in this sector.

The global beauty market is experiencing a period of significant growth and development. We have observed a period of digital disruption where Born-Digital and Indie beauty brands are experiencing rapid growth, chipping away at the market shares of Legacy beauty brands.

How does the online success of Indie Brands relate to J-Beauty?

Wearisma’s analysis observed this shift also occurring online as Indie brands drive conversations among French Influencers.

But why is it important that Japanese Beauty brands pay close attention to this digital disruption?

The growth of the cosmetics market and social media penetration in Japan mirrors the trends observed in France. This upward trajectory suggests that J-Beauty is ripe for expansion. Learning from social media focused Indie Brands who are quickly challenging both historic and homegrown beauty brands in France is an astute way to stay ahead of this competitive global market!

Background

The digital savviness of Born-Digital and Indie brands is a significant factor of their success. For example, our analysis revealed that Indie Beauty brands in particular constitute a powerful force, achieving on average, a higher engagement rate and media value per Influencer than Legacy brands. When investigating the French beauty market it appears that this growth is occurring alongside an increase in digital penetration.

In Japan, a 13% year on year growth in active social media users was observed between 2017 and 2018, more than double that witnessed in France. These findings coupled with the fact that beauty brands have recently begun creating localised Instagram accounts for the Japan Market suggests that Japanese beauty brands could benefit from replicating the same Influencer Marketing tactics utilized by the top mentioned Indie beauty brands in France.

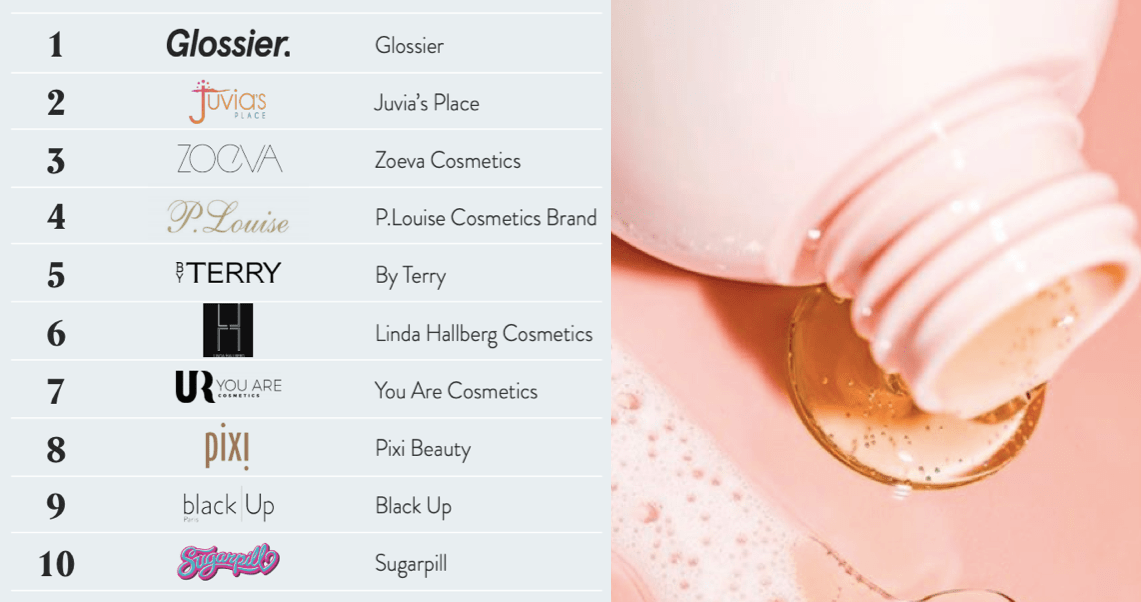

Below we will analyse the top three Indie beauty brands who reign supreme among French Influencers.

No. 1 Glossier

Glossier is the top mentioned Indie Brand by French Influencers. Rather than relying on celebrity endorsements and partnerships with Mega-Influencers, Glossier founder Emily Weiss claims to “believe in the power of the individual. And if you have many [individuals] who are electing your brand, who are excited about it and talking about it, then that is the equivalent of 10 Kardashians.”

Similar findings have been observed in Glossier’s Japanese market. For example, Wearisma’s data found that 4 out of the top 5 Influencers producing the highest engagement rate for Glossier each had less than 20K followers. In order to replicate the success of this Indie powerhouse, Japanese beauty brands should embrace the power of the Micro-Influencer.

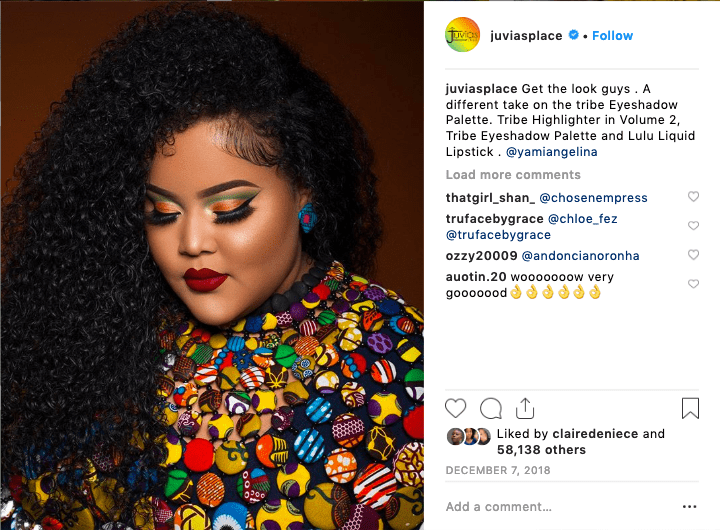

No. 2 Juvia’s Place

Taking the second spot is Indie brand Juvia’s place founded in 2013 by Nigerian born Chichi Eburu. Our analysis revealed that the top three Influencers producing the highest media value for Juvia’s place is Disabled Influencer Elsa Makeup (@elsamakeup), male Influencer Richard (@richaard2609) as well as Emilie Lapuly (@emilielapuly) who is a woman of colour. These results suggest brands who embrace inclusivity within their Influencer marketing practices gain more traction online.

Japan Buzz has revealed increased diversity to be a key trend in Influencer Marketing in Japan in 2019. Individuals like comedian Naomi Watanabe (@watanabenaomi703) and transgender influencer Genking (@_genking_) have gained a strong social media following largely due to their ability to represent individuals who have been historically underrepresented in the media. To achieve the same success as Juvia’s Place, Japanese beauty brands should follow suit and feature a diverse set of Influencers to promote their products on social media.

No. 3 Zoeva Cosmetics

Originating in Germany, 10-year-old Zoeva Cosmetics was the third most mentioned Indie beauty brand among French Influencers. Brand founder and CEO Zoe Boikou has cited Influencers as one of her main muses, taking inspiration for her own daily makeup routine from Influential beauty bloggers such as Tobi Makeup (@tobimakeup) and Cristina Constantin (@mimi.cristina) who both feature on the brand’s Instagram account.

Our analysis revealed that unlike Legacy and Born-Digital brands, Indie Brands achieve a higher media value from Influencers who specifically produce beauty related content. These findings suggest that Japanese brands may achieve the same international success by utilising similar Influencers and Makeup Artists within their social media campaigns.

Conclusion

The Japanese cosmetics industry is expected to grow annually by 1.6%, adopting these Influencer Marketing tactics could ensure that Japanese beauty brands capitalise on this growth in the digital space!

What do you think about these strategies and tactics? We’d love to hear from you!