In August, the Chinese microblogging platform, Weibo announced that it saw an increase of growth in Q2 (via younger users joining the platform) of 70 million additional users amounting to a total of 431 million monthly active users.

Weibo is on the rise again as this is coupled with net revenues of $426.6m in Q2 – a 68% increase year-on-year. The rise driven by robust advertising and marketing revenues, grew 69% year-on-year to reach $369.9m.

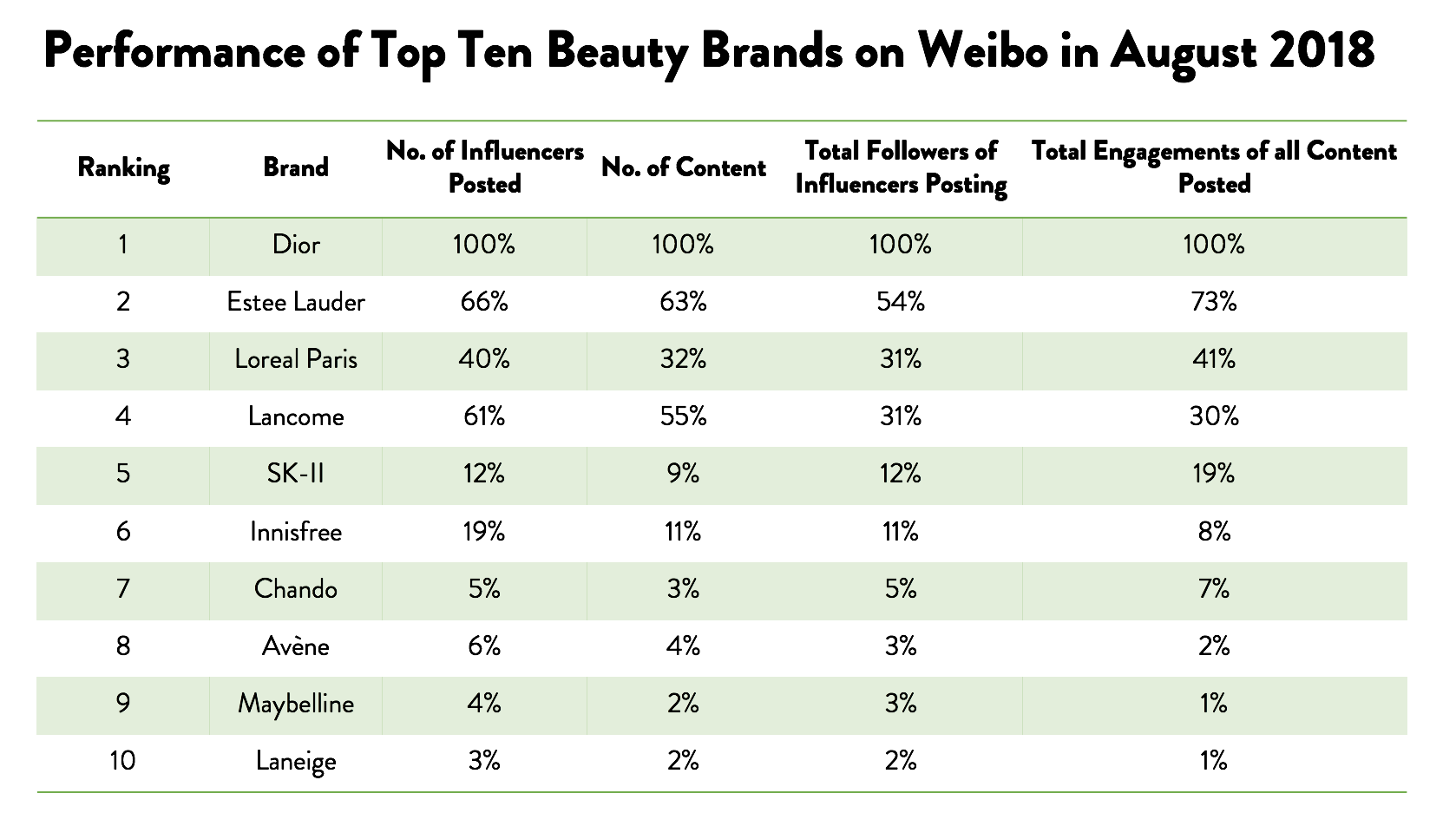

Earlier this year, Gartner’s L2 published their annual Digital IQ Index on Beauty in China for 2018. Using this, we decided to take a look at how well these beauty brands did in terms of coverage on Weibo during the month of August.

Wearisma Insight

International luxury fashion brands are quickly dominating the makeup space in China, therefore it is no surprise that the brand that dominated beauty on Weibo is Dior Makeup. Dior has seen huge success via digital in China and has notably been the first to sell on WeChat and adopt Weibo Stories in order to stay ahead of the curve. The success of Dior Makeup in China can be traced back to the fact that the Dior Make Up range acts as a gateway product which is accessible and can be bought online as quality from the brand is assured. Being an early entrant has lead Dior becoming the most engaged brand on Weibo in August.

That said, Estee Lauder is not that far behind Dior. Despite them having only half the total follower reach of Dior, the number of engagements they receive are only 30% behind meaning that despite having a tinier audience, that audience is still incredibly engaged. This could be down to Estee Lauder’s recent efforts to rejuvenate the brand and cater towards a younger demographic, which in 2017 led to a huge 40% increase in sales.

Another interesting case study for the month of August is L’Oréal Paris. Their strategy on Weibo is communicating on both a micro and macro level. All ten of their most followed influencers have over 5 million followers. They complement this with targeting micro influencers who deliver vast pieces of content. For instance, on average, every micro influencer that posted about L’Oréal Paris on Weibo has at least 3 pieces of content each. Doing this micro and macro approach helps L’Oréal Paris to generate a vast quantity of engagement on their content but also leads to higher brand awareness.