5 Tips for International Influencer Marketing

In our latest post, Wearisma’s analysis into the state of Influencer Marketing in Japan and Europe answers the pivotal question: ‘Can a brand simply copy and paste an Influencer Marketing strategy from one country to the next?’

In Influencer Marketing, there are a series of Dos and Don’ts that all brands should consider before developing a new strategy. For example;

Do: Utilise intelligent insights to optimise your Influencer selection.

Don’t: Rely on follower count as your main KPI

These are just two of a series of best practices that are universally applicable. However, as brands diversify and enter new markets, the Dos and Don’ts become less obvious. Can a brand simply copy and paste an Influencer Marketing strategy from one country to the next? Our analysis suggests that adopting such an approach can be disadvantageous. The conversations popular among Influencers, the specific type of Influencers producing engaging content and the way Influencers operate differ greatly from one country to the next. To highlight these differences, Wearisma has conducted a deep dive into the Influencer landscape in 3 countries: Japan, UK and France. These 5 observations will provide insight into why brands should use intelligent data to help them successfully adapt their global Influencer Marketing strategy.

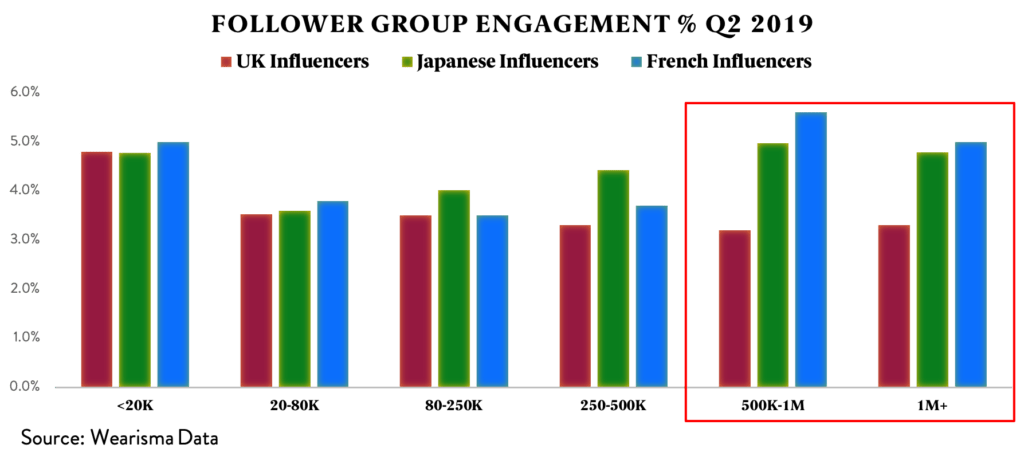

- In the UK and in line with global trends, Luxury Micro-Influencers achieve higher engagement rates than Luxury Mega-Influencers. However, in France and Japan, Wearisma’s data reveals that Luxury Mega-Influencers produce equally high engagement rates. Brands must be aware that the engagement rates achieved by Influencers in various follower groups are not universal. Carefully analysing country-specific trends will improve the success rate of Influencer selection.

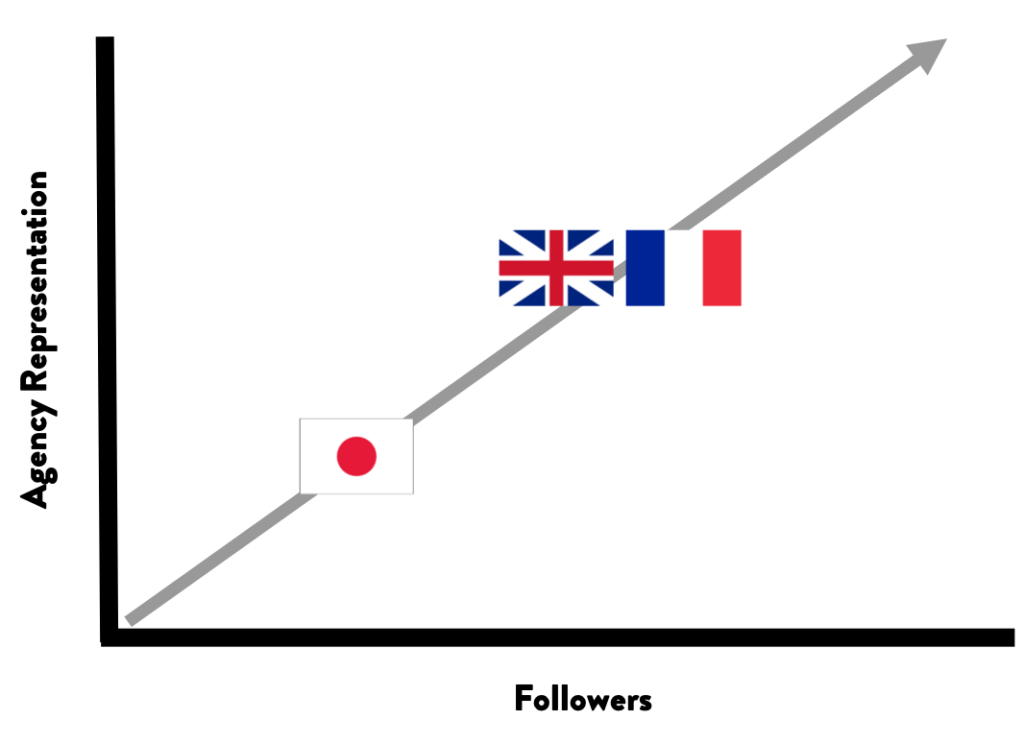

2. While European Influencers typically avoid using talent agencies until their following surpasses 100K followers, Japanese Influencers join talent agencies from just 10K followers. Brands working in this region must be aware that they are unlikely to be able to work directly with Influencers. Brands will have to consider each agency’s rules and guidelines regarding collaborations when engaging in Influencer Marketing in Japan.

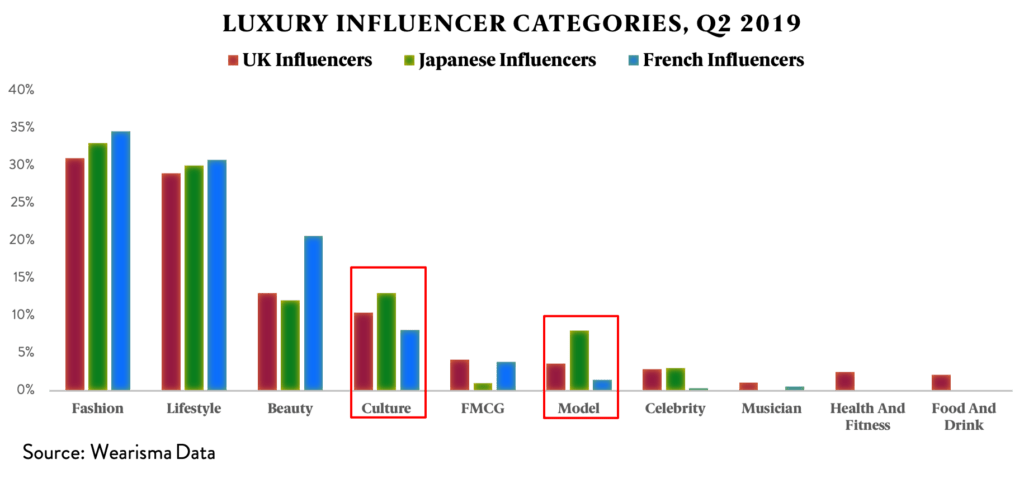

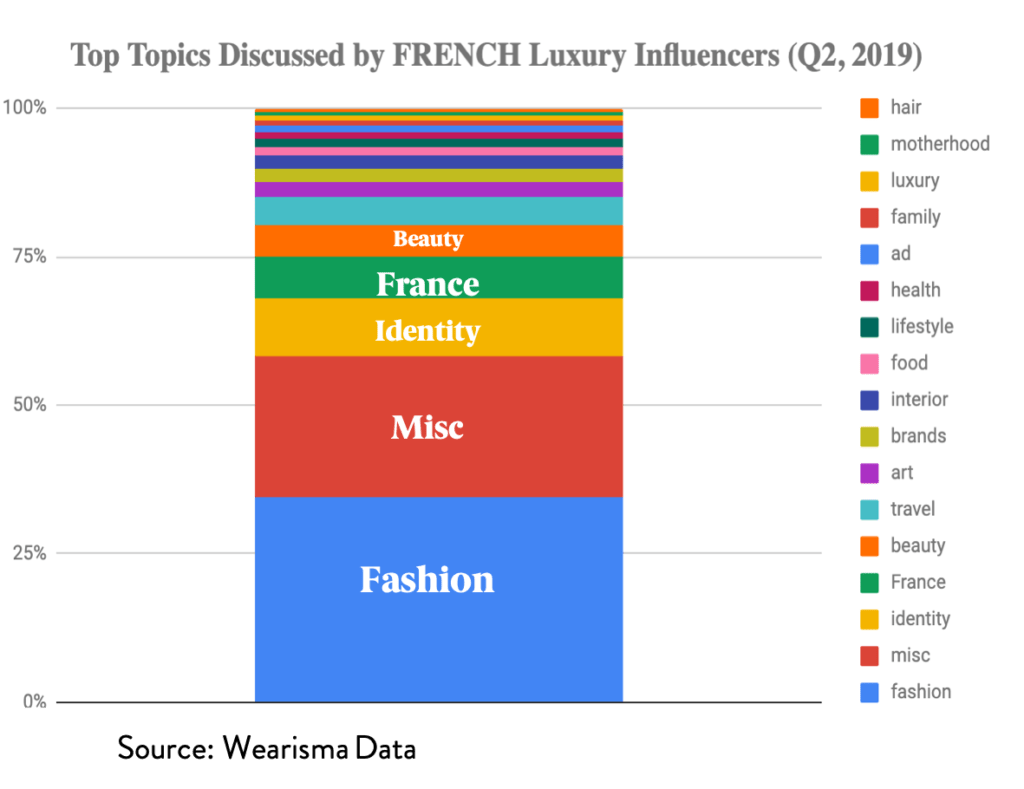

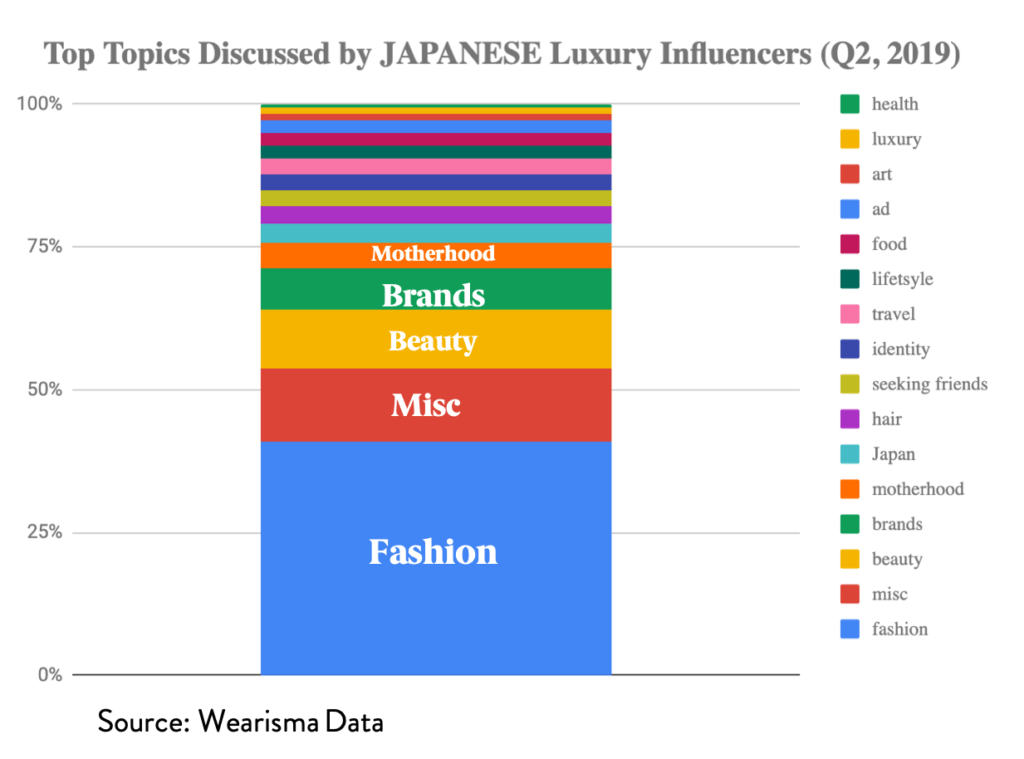

3. When considering the type of products to launch with the help of Influencers, brands should acknowledge the popularity of these products among Influencers in the region. For example, Luxury Influencers are more invested in Beauty in France than in the UK and Japan. Whereas content relating to Culture is more popular among Luxury Influencers in Japan than in the UK and France.

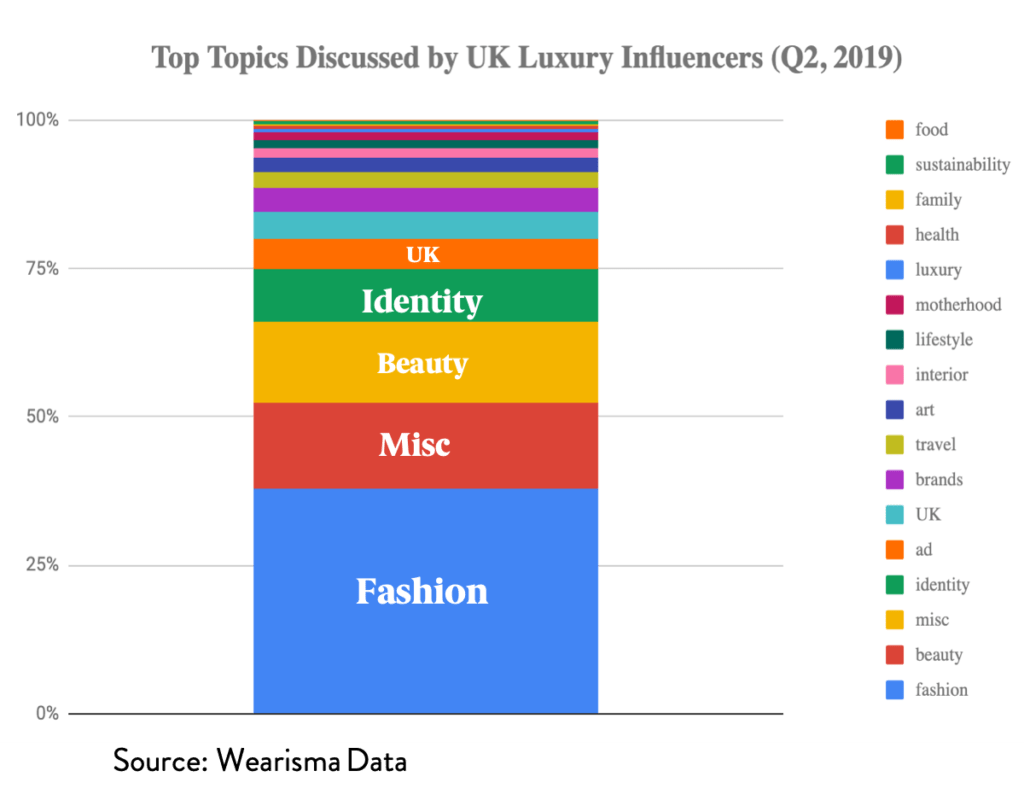

4. When considering the best way to utilise Influencers to communicate with a target audience, brands should be aware of the types of conversations popular among Influencers in different regions. For example, branded content and conversations surrounding motherhood are particularly popular in Japan. In the UK and France, conversations surrounding identity are more popular.

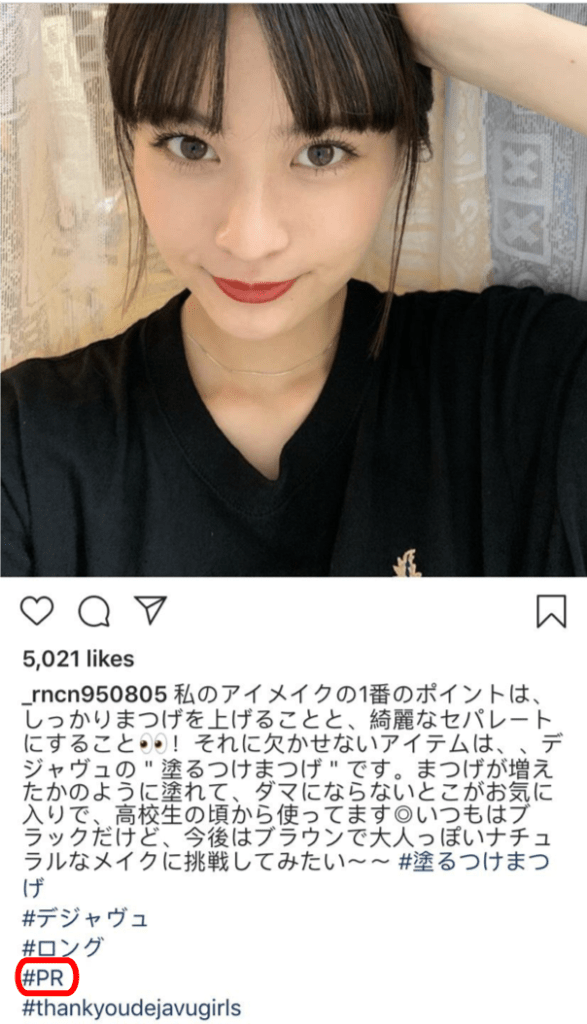

5. Transparency regarding sponsorship and collaborations is a hot topic in Influencer Marketing. However, brands should be aware that certain regions place greater importance on disclosing brand collaborations than others. For example, Ad related hashtags were the most mentioned hashtag in the UK and 4th most mentioned hashtag in Japan by Luxury Influencers in Q2 2019, while Ad related hashtags did not make the top 10 in France in the same time period.

By utilising intelligent data when engaging in global Influencer Marketing initiatives, brands will be able to adapt their Influencer strategy appropriately to suit each market. Adopting this tailored approach will ensure that brands are engaging diverse audiences in a more authentic way.

Want to discover the most popular Luxury brands among Luxury Influencers in Japan, France and the UK in Q2 2019? Subscribe to our Newsletter to find out.